Part 2:

How many streams of income do zillennials have?

The Zillennial Investing Report

Do Zillennials have multiple sources of income? Are some demographic groups more likely to have numerous income streams than others? What percentage of Zillennials supplement their primary income stream with investments and “side-hustles”?

To address these questions, we asked our respondents how many income streams they have. Any consistent and steady influx of money is considered an income stream. Active income is paid out through wages, salaries, and commissions, while passive income is money earned from interest, dividends, and rental property.

Ya, but who cares….how many income streams you have? In our world of insecurity— both financial and personal – most of us have learned the dangers of relying on one thing: a job, a stream of income, or even a person.... On the other hand, seven bad, unreliable streams of income (or relationships) are worse than one solid, reliable one. New poll question: what's more nauseating: hearing some talk about their COVID crypto investing fails or COVID relationship fails? Option C: all the above.

For the same reason you want to diversify your investment portfolio, diversifying your income sources can make you more resilient to change. Let’s imagine a surprise global pandemic results in you getting laid off from your primary job. If you have a side-gig as an SAT tutor or freelance web designer, that income might help you cover your costs in the short-term. On the flip side, those who have strong salaries and feel secure in their current jobs might not feel the need to augment their income. The bottom line is that anyone who relies solely on paychecks is missing out on an opportunity to compound their income through investing, but that’s for us to dig into later on.

For now, let’s see what our respondents’ told us about their income streams…

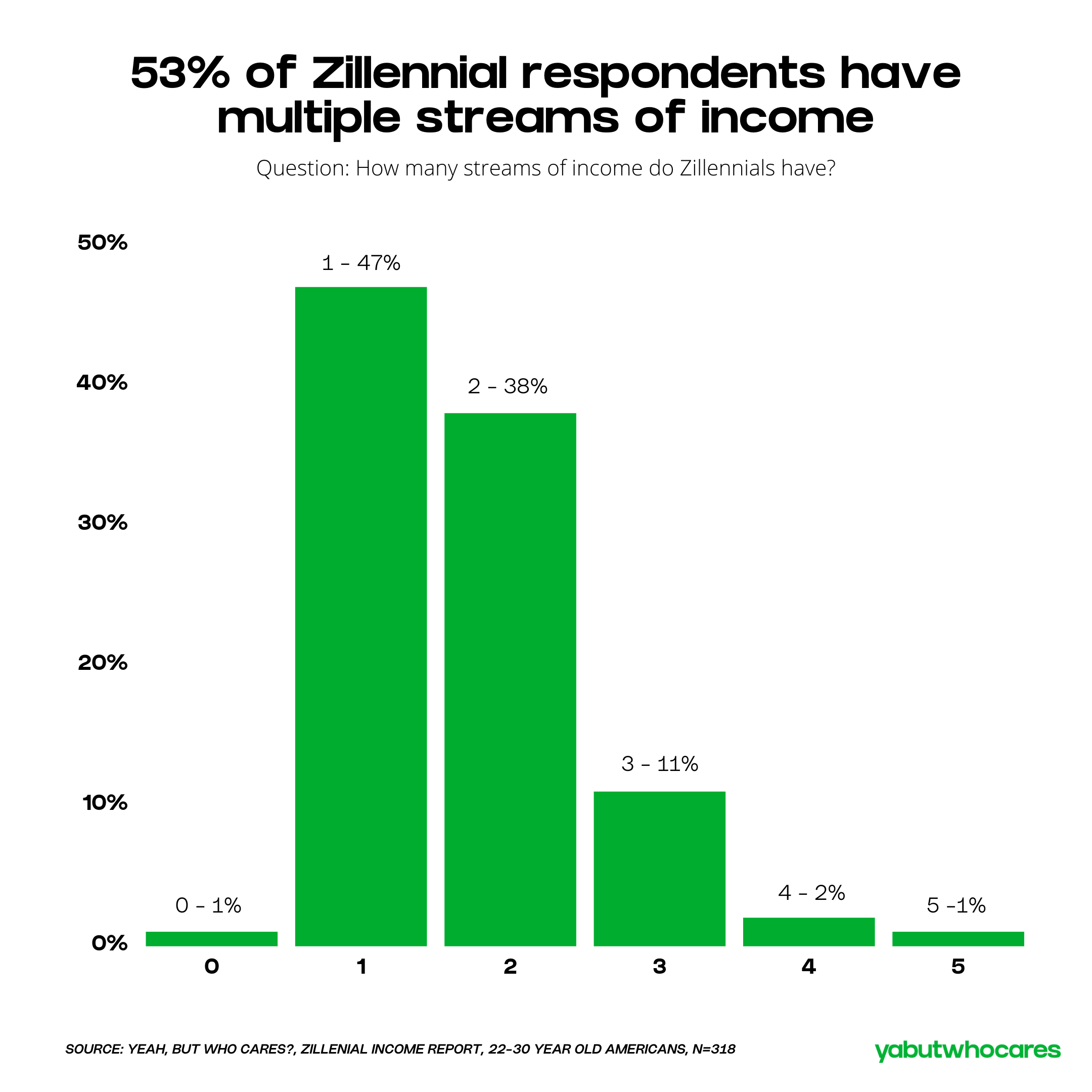

Insight53% of respondents have multiple streams of income

47% of individuals reported having one stream of income, 38% reported having two, and 14% of respondents reported having more than two.

Traditionally, as one advances in their career they gain more streams of income. You know what they say…the more you age the more you raise (capital… distributed…across…revenue…streams?). OK, idk if they say that, but they should.

There are several strategies one can take to build multiple streams of income. You can maximize your primary salary by reinvesting a percentage of your paychecks into other ventures and assets. Alternatively, you can build more income sources by taking on part-time work in addition to your primary job.

To understand why these respondents might have multiple income streams, let’s explore what demographics make up this 53%...

InsightRespondents who work in “arts, design, entertainment, sports, and media” were most likely to have more than one stream of income.

64% of respondents in the “arts, design, entertainment, sports, and media” industries reported having more than one stream of income, compared to 50% of those in financial services and consulting and 48% of those in tech. Members of these industries were also the most likely to have more than two streams of income.

In more creative industries, freelancing and side hustles come with the territory. It’s only getting easier for people in the creator economy to find work and manage their finances through platforms like Upwork, Freelancer, and Fiverr.

Based on the average wages for workers in creative industries, one could also assume they are pursuing alternative income sources out of necessity. According to a 2020 Statistica survey, the average salary for a full-time employee in the “information” industry topped the list at $147,732. “Finance and insurance” ranked third highest at an avg. $124,106 and “Professional, scientific, and technical services' ' was sixth at $113,114. Comparatively, “Arts, entertainment, and recreation” was number 15 at an average $59,328.

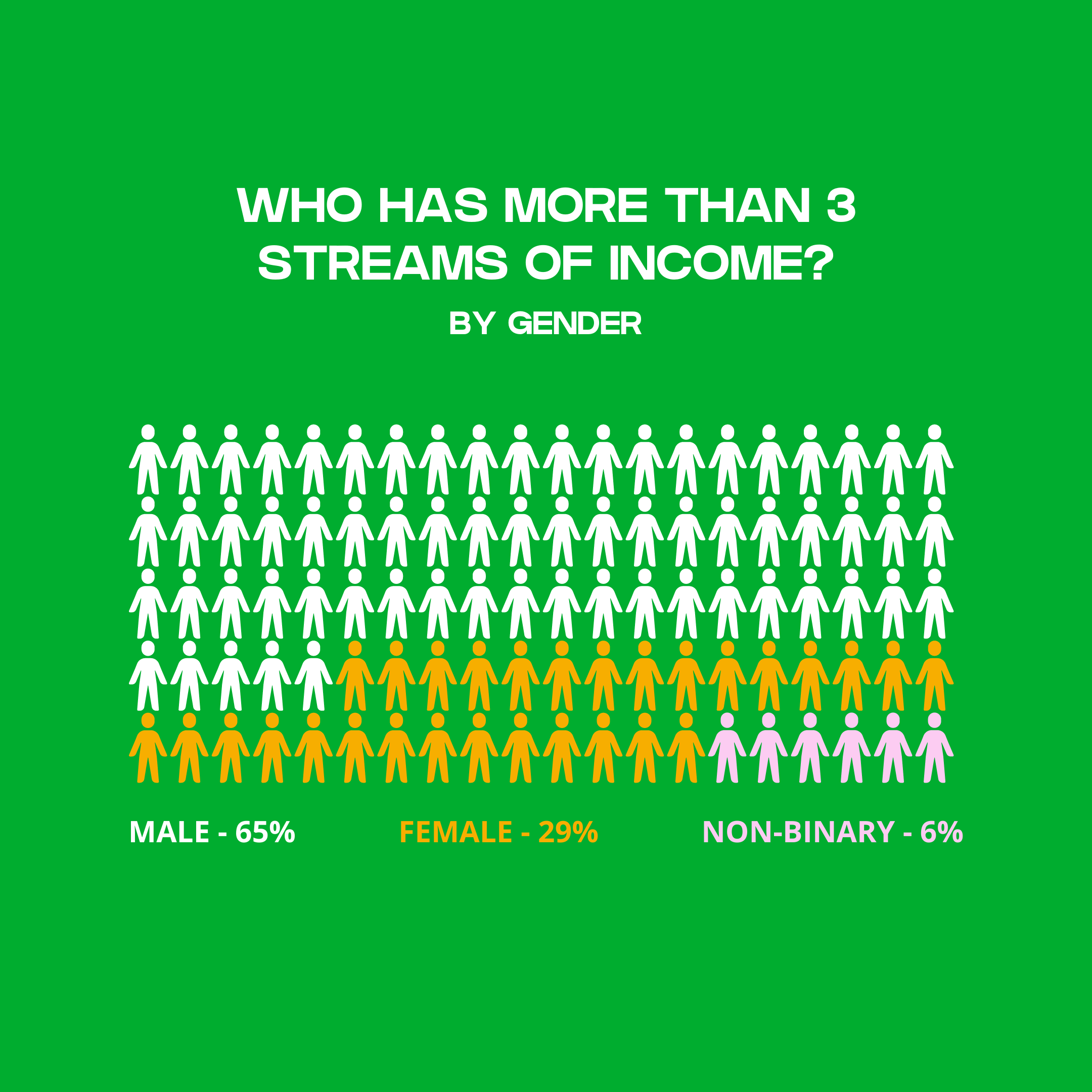

InsightMale respondents were 30% more likely than female respondents to have more than one stream of income.

60% of male respondents had more than one stream of income, compared to 46% of female respondents, which implies that women rely more heavily on their primary paycheck than men and may be less likely to look for other income sources.

This finding reminded us of a figure from our last report on investing -- that women were ~8 times more likely to not invest their money than men. Considering that our female survey respondents were less likely to be investors, it makes sense that over half of them only have a single income stream.

But what about entrepreneurship? Side hustles? One could also point to the gender gap in entrepreneurship as a potential explanation for women’s lack of income streams. As of 2018, female-owned companies accounted for only 19.9% of businesses with employees in the U.S., according to the U.S. Census Bureau. The same census data showed that female business ownership is increasing, but not by much. Between 2017 and 2018, the number of women-owned businesses increased by 0.6%.

InsightHispanic or Latino respondents were 53% less likely to have more than one stream of income compared to non-Hispanic respondents

30% of Hispanic respondents reported having more than one revenue stream compared to 56% of non-Hispanic or Latino respondents, revealing that the Hispanic or Latino participants in our survey were more likely than other racial or ethnic groups to depend on a single income source. Like our female respondents, Hispanic or Latino participants seem to be investing their money or participating in side hustles less often than other groups.

InsightRespondents with a graduate degree were only marginally more likely to have more than one stream of income.

58% of graduate degree recipients had more than one stream of income compared to 52% of people with an undergrad degree. Master’s degrees are consistently linked to salary boosts in studies. However, our survey revealed that people with graduate degrees were slightly more likely to have diversified income streams. It’s reasonable to assume that these graduate students have stronger salaries and may not feel a need to supplement their income.